When most people think of an accounting system, they usually consider tasks like bank reconciliations, creating invoices, and tracking bill payments. While these are key functions, products like Xero, MYOB, and QuickBooks offer many other features that can make your life easier, provide more powerful reporting, and help manage your business more effectively.

This article explores some hidden gems within your accounting software. While not all software packages have all these features, many of them are available to use now.

Bank Rules

Allocating bank transactions is one of the most monotonous tasks in any accounting system. Bank reconciliations can take business owners hours every week. Some accounting software programs aim to reduce this time by using machine learning algorithms to analyse receipts and payments. These algorithms ‘guess’ where transactions should be allocated, but they can be inaccurate and cause misallocations.

A better way to save time and prevent errors is to set up your own custom bank rules. These rules allow you to tell the system where to allocate payments based on criteria like:

- Payee

- Description

- Amount

- Reference

Rules will also allow you to split the payment between multiple accounts, if you regularly need to split recurring payments. They can also be used to assign transactions to a particular ‘Tracking Category’, which we explore further below.

Tracking Categories / Cost Centres

One of the most underutilized features in accounting software is Tracking Categories (also known as Cost Centres in other software products). These allow you to generate more powerful reports. Examples include:

- Setting up a ‘Job’ Tracking Category to report on the profitability by job

- Setting up a ‘Department’ Tracking Category to report on revenue and expenditure by certain departments

- Setting up a ‘Event’ Tracking Category to report on the profitability of different events

- Setting up a ‘Account Manager’ Tracking Category to report on the revenue and client retention for different account managers

Tracking Categories can be coupled with Custom Reporting in accounting software to quickly and easily produce custom reports specific to your organisation.

Custom Reporting

Accounting software providers empower users to create their own custom reports. You can start by editing standard reports like Budget Variance or Accounts Receivable to group, summarise, or filter by accounts or Tracking Categories. You can also add new columns or rows to include additional periods or calculate different sub-totals/ratios within your reports.

For more advanced users, the ‘Blank Reports’ feature allows you to create reports from scratch by selecting accounts, periods, and performing custom calculations. This is great for setting up reports for different areas of your organisation.

Recurring Bills / Invoices

An easy but effective way to save time with your bookkeeping process is to set up recurring bills or invoices. The recurring bills also help to ensure you don’t suffer adverse consequences from missing important bill payments. Recurring bills or invoices can be set up for any transactions that occur regularly and can usually be set up to end at a certain time or after a certain number of occurrences. Additionally, they can be set up to approve straight way, or to create as a ‘draft’ bill/invoice for your approval.

Examples of recurring bills you could set up in your organisation may include:

- Telephone bills

- Subscriptions (such as accounting software)

- Rates instalments

- Workcover instalments

- Contractor invoices

Likewise, recurring invoices can be set up where you invoice a customer on a set time basis (e.g. annual memberships or monthly retainers) or where you have an instalment agreement with a customer (e.g. paying a fixed amount monthly for several months).

Integration and API’s

Finally, one of the best ways to automate data coming in and out of your accounting software is through integrations and API’s.

Integrations

Integrations can help enter data into your accounting system for you. They can help to enter bills, create invoices, manage approval processes or enter timesheets for employees. Generally, access to these integrations can be shared across the business so that data is collected by the end user, not sent to a bookkeeper or business owner to manually enter. This helps cut down on time taken to complete tasks, ensure that data is entered in a timely fashion and that the data is more accurate.

API’s

Application Programming Interfaces (or API’s for short) allow third-party applications to get data out of your accounting software to create even more customised and powerful reporting. Access to this reporting can again be shared across the business, with access restricted to that people can only see information that is relevant to them.

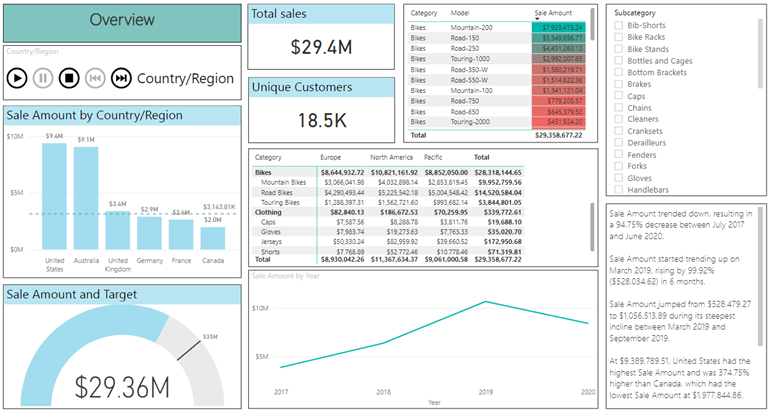

Programs like Power BI can integrate with major accounting software systems, allowing business owners to drill down on data in real-time for quick and accurate decision-making.

An example of a PowerBI dashboard created by using an API with Accounting Software

Unlock The Full Potential Of Your Accounting Software

By leveraging these advanced features in your accounting software, you can streamline processes, generate insightful reports, and enhance your business management. Our team at Accru Melbourne are ready to help you maximise these tools and take your business to the next level. Contact us today to learn how we can tailor these solutions to meet your specific needs and drive your business forward.

For more information on how this affects you or your business, contact the experts at Accru today.