As the Australian Government moves to roll out mandatory ‘e-Invoicing’ systems, terms like ‘e-Invoice’ and ‘Peppol’ are showing up more and more frequently. But what do they actually mean? And what will they mean for you?

Although a timeline has not been confirmed, the Government has indicated that all Australian businesses will need to implement an e-Invoicing system. In fact, you may have already encountered it! E-Invoicing has been mandatory for Government Agencies since July 2022.

What is e-Invoicing?

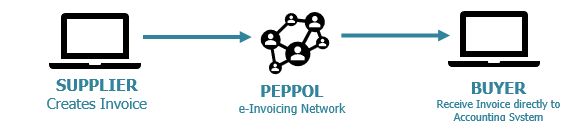

e-Invoicing is the term used to describe the electronic transfer of invoices through a secure network from the accounting system of the seller to the accounting system of the buyer. This process aims to eliminate paper and PDF-Based invoices that are currently being printed, posted or emailed.

The buyer receives an electronic invoice directly through their accounting system – removing the need to manually input invoice data.

What is Peppol?

Peppol is the network that allows e-invoicing to operate. All business will be required to register their accounting software within the secure Peppol network. This allows Peppol to direct all invoices receive to the correct buyers accounting system.

Peppol is an internationally recognised network that is currently being used by over 30 countries in Europe, Asia and North America.

Why?

There are several benefits that e-Invoicing:

- e-Invoicing improves efficiency for both the seller and buyer. Invoices land directly in the accounting systems of the buyer, reducing any electronic or paper communication from a seller that could get lost or missed. Buyers won’t have to manually transfer an invoice into their accounting system, saving time and paper.

- The accurate & secure exchange of invoice details via the Peppol network will reduce the risk of emails scams and fraud. It is becoming increasingly common for emails to be intercepted and invoice details modified before they reach the buyer. The in-built database ensures accurate delivery of invoices to the buyer.

- Invoices will be paid faster. The direct nature of the e-Invoice system reduces human errors, like missed invoices or incorrect addresses, that can cause payment delays.

When?

From July 2022 e-Invoicing was rolled out and mandated to Australian Government agencies. The Australian Government is currently working with State and Territory Governments to roll out e-Invoicing to all government Agencies.

The Australian Government has not yet confirmed the timeframe but has proposed the below implementation phases to support the adoption.

- 1 July 2023: Large businesses (with a turnover above AUD 50 million)

- 1 July 2024: Medium-sized businesses (between AUD 10 million and 50 million)

- 1 July 2025: Remaining businesses

How?

When e-Invoicing is rolled out to your business, you will be directed to register through your accounting software. Many accounting packages already offer e-Invoicing and you can register on the Peppol network using your software. This process is quick and easy.

Once you have registered for ‘e-Invoicing’, Peppol will use information like ABN and Software ID to direct the invoices to the correct buyers accounting system.

The process for buyers depends on the accounting system used. For most, invoices received through the Peppol network will be stored in a ‘Draft’ group for action.

If you need help navigating the transition to e-invoicing, get in touch with your local Accru Advisor.

"

"