Business Taxation Highlights

In a pre-election Budget mainly focused on households, businesses have not been completely forgotten. This year’s Budget focused on the smaller end of town, extending existing tax relief for small and medium businesses and expanding the instant asset write-off.

Business Taxation

Small and medium business

The Treasurer was unequivocal in the Government’s support for business and SMEs in particular. Measures were announced in the Budget relating to both investment and tax integrity rules for SMEs of varying sizes.

Instant asset write-off

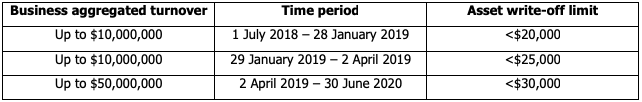

The instant asset write-off has been extended in both threshold and duration for several consecutive years now. It has always been intended to stimulate economic activity and encourage businesses to invest. The scope for this has definitely broadened as a result of this Budget, but it does appear that there are now three thresholds for this financial year, assuming the measure passes into law.

Based on Budget announcements, for the 2019 and 2020 financial year the following is applicable:

Division 7A amendments start date deferred 12 months

The Government will defer the start date of the 2018-19 Budget measure, Tax Integrity — clarifying the operation of the Division 7A integrity rule, from 1 July 2019 to 1 July 2020. Changes to Division 7A have been announced in the last few Budgets and would now be consolidated into a package that applies from 1 July 2020.

Following a Board of Taxation review and series of recommendations, the Government issued a consultation paper in October 2018 seeking stakeholder views on the proposed implementation approach for the amendments to Division 7A of the Income Tax Assessment Act 1936. Feedback from stakeholders highlighted that this is a complex area of the tax law and raised implementation issues that warrant further consideration.

Delaying the start date by 12 months will allow additional time to further consult with stakeholders on these issues and to refine the Government’s implementation approach, including to ensure appropriate transitional arrangements so taxpayers are not unfairly prejudiced.

Incentives, grants & exemptions

Skills package – new apprenticeships

As part of a $525 million skills package seeking to create 80,000 new apprenticeships over five years, the Government will double incentive payments to employers to $8,000 per placement. The payment will provide employers with the following payments:

- $1,500 at the commencement

- $2,000 after 12 months

- $4,500 at the completion.

Export Market Development Grants (EMDG) additional funding

An additional $60 million over three years will be invested into the EMDG scheme, which supports businesses to increase marketing and promotional activities overseas, with the intention of growing exports into new markets.

To be eligible, a business needs to have a turnover less than $50 million in the grant year, incurred over $15,000 of eligible expenses and have principal status for the export business. It must also be promoting specific activities related to exports, inbound tourism or conferences and events held in Australia.

The EMDG scheme reimburses up to 50% of eligible expenditure above $5,000, provided that total eligible expenses are at least $15,000.

North Queensland flood recovery tax exemption

The Government will provide an income tax exemption for qualifying grants made to primary producers, small businesses and non-profit organisations affected by the North Queensland floods. Qualifying grants include Category C and Category D grants provided under the Disaster Recovery Funding Arrangements 2018, and grants provided under the On-Farm Restocking and Replanting Grants Program and the On-Farm Infrastructure Grants Program.

The exemption will apply where the grants relate to the monsoonal trough, which produced flooding that started on or after 25 January 2019 and continued into February 2019.

Queensland storms – tax treatment of payments to primary producers

The Government will treat as exempt income payments to primary producers in the Fassifern Valley, Queensland affected by storm damage in October 2018. The tax treatment relates to payments distributed to affected taxpayers through a grant totalling $1.0 million to the Foundation for Rural and Regional Renewal, working with the Salvation Army and a local community panel.

Corporate Tax Rate

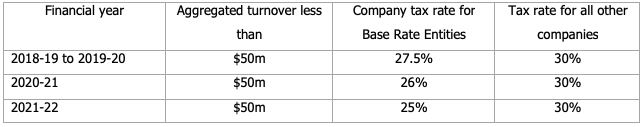

The Government remains committed to the 10-year enterprise tax plan announced three years ago. Attempts to extend the corporate tax cuts to companies over $50 million have failed thus far, but presumably, the Government will continue to make efforts to pass them.

They have succeeded in bringing forward the tax cut for ‘Base Rate Entities’. A Base Rate Entity for 1 July 2018 onwards has aggregated turnover below $50 million and that has 80% or less of their assessable income as ‘base rate entity passive income’, which is a specified range of investment income amounts.

Therefore, the current corporate tax rates are as follows.

See our separate coverage on Federal Budget changes announced affecting individuals and superannation, which also includes Labor party’s key policy announcements made over the past year. Further if you would like to discuss your business with one of our trusted Business Advisory Specialists, contact us on (03) 9835 8200 or alternatively fill in your details below and we will be in touch.