Do you want to get paid faster for your services? Check out our quick tips to better invoicing!

Small business owners juggle a number of different tasks that they have to complete each day and sending out invoices to customers is just another one of those tasks. But why not make it quick and simple to send out invoices, track them and receive the money as quickly as possible?

In the first in a series of articles on how to get the most out of your cloud accounting software, we talk about how to get the most out of your invoicing functions in your cloud accounting software.

Send Invoices fast

No need to send out invoices by mail or even copy/paste job by e-mail. Cloud accounting allows you to send invoices direct to customers anytime, anywhere immediately using the accounting software or mobile app straight to their e-mail address.

Have customers that you send invoices to regularly? Then schedule invoices to be generated and sent out automatically so you don’t have to touch a button.

Client Tracking

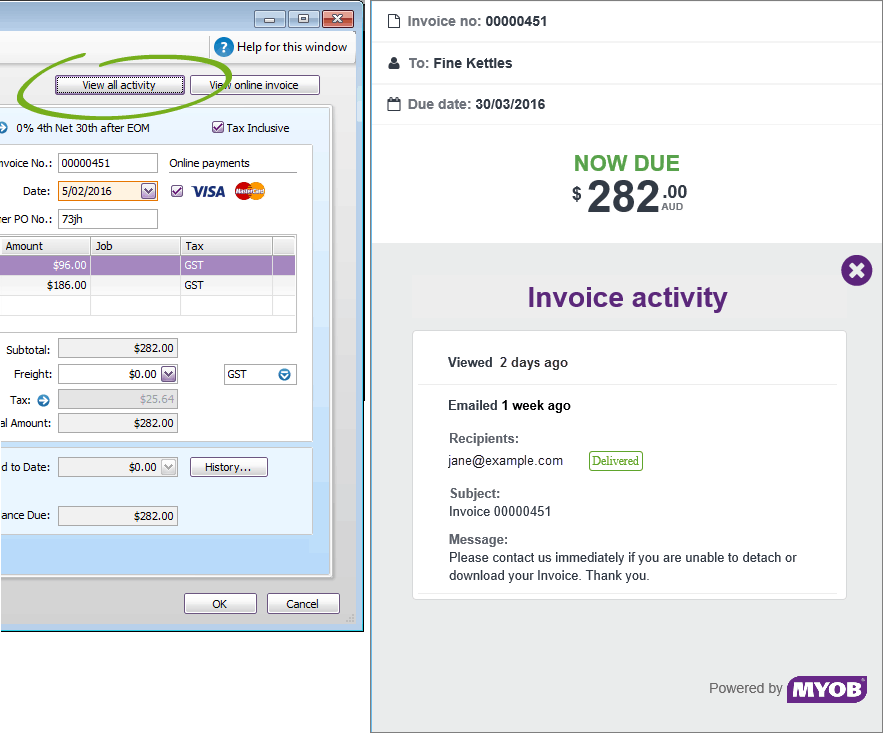

Once an invoice has been sent to a customer, you will be able to track the activity of the invoice and see if the e-mail has been received and when they last viewed the invoice. No more excuses that they haven’t seen the invoice and making chasing the money from customers easier.

Quick Reminders

Send out automatic gentle reminders to customers who have amounts outstanding. For customers that you have great relationships with, or those that owe a small amount, simply set parameters so exclude reminders if they’re deemed not necessary.

Faster Payments

Make the client experience quick and easy by accepting online payments with the use of a payment services such as Bpay, PayPal, Stripe or eWay, among the payment services that MYOB, Intuit and Xero connect to. Data from these providers shows that on average the establishment of an online service facilitates customers paying up to two times quicker compared to those without these options.

We have expertise in all of these software providers and will be able to assist with any that you are currently using or would like to know more information about. If you would like to discuss which software is best for you please contact one of our Business Advisory Specialists today.