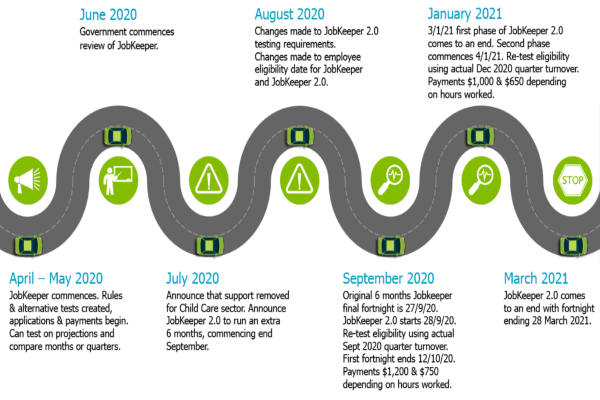

On the fourth of January 2021 we rounded the final turn on the long and winding road of the Government’s JobKeeper program. It is currently going to end on 28th March 2021. Originally intended to end in September of 2020, JobKeeper was extended under the title ‘JobKeeper 2.0’, although it was more like Jobkeeper 2.1 and 2.2.

The key points for what should be the final extension of JobKeeper are as follows:

Can I participate if I missed out on the initial JobKeeper 2.0 extension in September 2020?

Yes, provided you satisfy the decline in turnover test for the December quarter. Missing out on JobKeeper from September to December does not preclude you from accessing JobKeeper for January through to March.

Do I need to re-test eligibility?

Yes. To participate in the final 3 months of JobKeeper support the business needs to re-test and prove a 30% decline in turnover for the relevant period. For the basic test, this will require that the actual GST turnover for the quarter of December 2020 is 30% (or 15% for charities or 50% for large businesses) lower than the actual GST turnover for the quarter of December 2019.

If the basic test is failed, then an alternative test can be considered, but the alternative tests are limited to the ones specified by the Commissioner of Taxation. The alternative tests are based on testing a different 3 month period than December 2019, which generally will be either up to 1 March 2020, or 1 October 2020. Our report on the alternative tests for JobKeeper 2.0 is here.

Is there any change to employee eligibility?

No, the rules around when employees needed to be engaged, their employment status, start date and residency/visa requirements are the same as they were in August 2020, when the last update to employee eligibility was made. Here is our report on those changes.

What is the minimum fortnightly wage payment?

The rate of wage support has decreased again for JobKeeper, meaning that the minimum payment to employees on JobKeeper support has decreased. Employees still need to be paid the minimum by the end of each fortnight for the employer to be eligible for reimbursement. For the final phase of JobKeeper from 4th January to 28th March, the two tiered payment system is as follows:

- $1,000 per fortnight for the higher rate

- $650 per fortnight for the lower rate

The higher and lower rates are based on whether the eligible employees worked 80 hours in their applicable ‘reference period’, which was generally the 28 days leading up to 1 March 2020 or 1 July 2020. Our JobKeeper 2.0 extension update referenced above has further details on this point.

What are the relevant dates?

Although the final phase of JobKeeper is already underway, given that it commenced over the New Year break when many people are taking a break, the testing, nomination and minimum payment requirements have all been extended. The relevant dates are as follows:

| 4th January | Final extension commences. Payment rates change. |

|---|---|

| 28th January | The final due date for the December declaration for businesses that were eligible for the first JobKeeper 2.0 extension. Lodging this earlier means you will be reimbursed for wages earlier. |

| 31st January | The latest date to submit the decline in turnover test to the ATO to confirm eligibility for the final phase of JobKeeper. |

| 31st January | The latest date to ensure that the minimum wage condition is met for all eligible employees. Normally employees need to be paid the minimum by the end of each fortnight, but this has been relaxed for January. |

| 14th February | Latest date to submit monthly declaration for January 2021 |

| 14th March | Latest date to submit monthly declaration for February 2021 |

| 28th March | The end of the final fortnight of JobKeeper 2.0. |

| 8th April | The latest due date for the final JobKeeper 2.0 monthly declaration. |

The ATO has a detailed look at key dates here.