What is the best way to save?

One of the many pleasures in life is being able to successfully save for that one specialty item that you have always wanted; it can be anything from a new car, to a holiday or maybe even the wedding of your dreams. Unfortunately for a lot of us, when faced with the challenge of saving a large sum of money we can become over whelmed which leads us to lose motivation and essentially not achieve our goal. There is one simple method to follow with easy steps to ensure that you can overcome the challenges faced when saving for that special item.

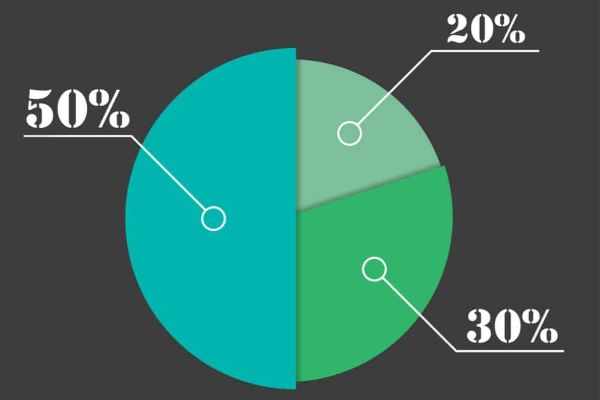

There is a general financial rule to base your spending patterns that is known as the “50-30-20 rule”. This rule states that you should aim to spend 50% of your income on necessities (such as housing or bills), 30% of your income on wants (such as entertainment and leisure activities) and the final 20% towards your financial goals (such as paying off debt or saving for retirement). As a specialty item is a financial goal, the rule implies that you should be saving 20% of your take home salary to put towards the item that you are after. The challenge with saving 20% of your salary is trying to keep track of your bank account and how much should be left in there at the end of each week which leads us to step one.

Step 1: Open up a new bank account

Now this step might sound like a lot of effort or challenging but in reality it is as simple as a few clicks of your mouse. As an existing customer, majority of banks will allow you to open up a new account online using your existing details. You ideally want to open up a high interest account as this will aid you in achieving you goal.

Step 2: Start an automatic transfer

Once your account has been activated you then want to start an automatic transfer after each pay check to this account. This ensures that as soon as you are paid, 20% of your income will be transferred straight into your high interest account. This step takes away any administrative work on your behalf and ensures that you stay on track. You can do this be either asking your employer to pay 20% of your income into your high interest account or you can start a recurring direct debit using your online banking facilities.

Step 3 (optional): Transfer any remaining money across

Now that you have your automated transfers set up, all you have to do is sit back and wait for your bank balance grow. There is however one more optional step that will help you achieve your goal in a shorter time frame. Unfortunately, there is some small administration involved with this step hence why it is optional. Any money you have left over from your previous pay check can be transferred to your high interest account as soon as you received your new pay check. This will mean that in fact you are actually saving more than the recommended 20% of your income.

By following the 3 easy steps outlined above, not only will you be able to afford your specialty item with next to no effort but you will have started to create a savings habit that you will have for life.

If you’re looking for the right solution for you, speak to one of our Financial Specialists today, complete your details below and we’ll be in touch or give us a call on (03) 9835 8200.

DISCLAIMER: GENERAL ADVICE ONLY

The information provided in this blog is general in nature. It has been prepared without taking into account any person’s individual objectives, financial situation or needs.

Before acting on any information in this blog, you should consider its appropriateness to you, having regard to your objectives, financial situation and needs or seek professional advice from a financial advisor.