Your business may need to report the total payments made to contractors each year on the TPAR.

Running a successful SME comes with a great sense of satisfaction however as Australian businesses are all too aware, it also comes with a heavy compliance load whether that be industry regulation, Fair Work, Occupational Health and Safety, Corporations Law and Income Tax Law among other things.

The income tax reporting burden has been changing over the last few years as the Government and Australian Taxation Office (ATO) seek to access more and more data. The most recent and obvious example has been the implementation of Single Touch Payroll. Another reporting obligation that has expanded in the last two years is the Taxable Payments Annual Report (TPAR) system.

What is TPAR?

It is third party reporting of certain tax related information to the ATO by suppliers of certain services. In this context it is reporting to the ATO annually of payments made to contractors where they are engaged to help provide your services. The ATO can then use this information to data match the contractors annual income declarations to assist their compliance efforts.

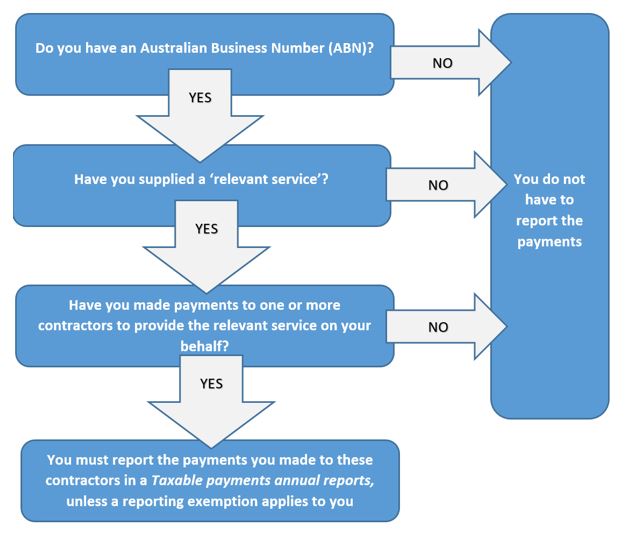

Diagrammatically, the ATO represents the system this way (in LCR 2019/4):

What is a ‘relevant service’?

There have been three different dates introducing reporting requirements for different relevant services:

- From 1 July 2012, contractor reporting initially applied to the building and construction industry.

- From 1 July 2018, the system was expanded to include courier and cleaning services.

- From 1 July 2019, the reporting system was further expanded to include; road freight services, security, investigation or surveillance services and information technology services.

What is the reporting requirement?

Suppliers of relevant services must report any payments made to contractors if the supplier has an ABN, the payment is at least partly for providing that service on their behalf and there is no exemption in place. For the services introduced from 1 July 2019 for example, the main exemptions are where the payments for the relevant service are less than 10% of projected turnover.

Contractors include sole traders, companies, partnerships and trusts, meaning the operating structure of the contractors is not relevant.

The amount to report is the payments actually made to contractors during the year, so reporting is done on what is referred to as a ‘cash basis’.

The particular service provided and who it is for, along with the inclusion and engagement of subcontractors can complicate the process, so it is best to understand who needs to be reported on at the start of the financial year.

Other considerations

The TPAR is ultimately targeted at compliance for the contractors but it can result in compliance issues for your business.

It is common for the ATO to review contractors as part of a payroll or BAS review/audit and certain issues can arise, such as incorrect withholding tax or incorrect GST claims. As part of this process it can be valuable to undertake your own audit of contractor payments to ensure that the right ABN is in place for contractors and that the right amount of GST is being claimed on payments to them.

Another issue is making sure that your accounting system is setup to easily capture the required information. Your system should be capturing this information during the year as you transact so that there is no need to work back through a year of data to prepare these reports at the end of the year.

Contact our Tax and Advisory Specialists today to find out more about your reporting obligations or to discuss the current situation of your business. Alternatively, you can complete your contact details below or give us a call on (03) 9835 8200.