Keep up to date with the latest JobKeeper changes

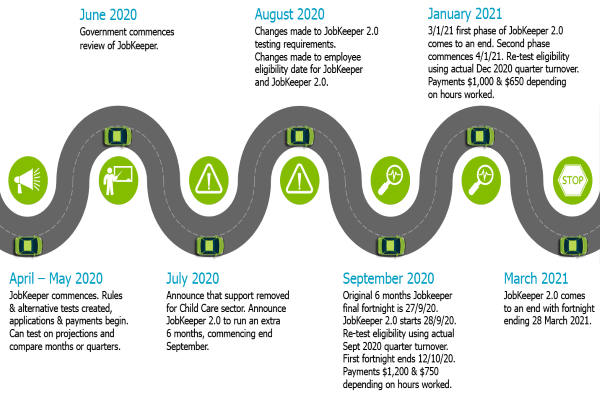

There have been a lot of changes announced to JobKeeper since the program began operation in April 2020. Late July through to the end of August, in particular, had a number of announcements which affected both JobKeeper and JobKeeper 2.0, which has created some confusion over how things are currently placed.

JobKeeper – original program

There was one change announced to the JobKeeper program in August. That change related to the eligible employee start date, which moved from 1 March 2020 to 1 July 2020. The source of confusion for this announcement is that it relates to the current JobKeeper program, but was announced after JobKeeper 2.0 was announced.

What is also important is what didn’t change as part of this announcement. Anyone who was eligible at 1 March and is still employed remains eligible for JobKeeper. Consistent with the original design and subsequent announcements, there is no need to re-test eligibility of original JobKeeper either. This leads to the second major announcement made recently.

JobKeeper 2.0

JobKeeper 2.0 was announced on 21 July 2020 and as a result of Victoria’s heightened restrictions on social movement and commerce has already had changes announced, even though the formal rules have not been published yet.

In summary, the key points for JobKeeper 2.0 are:

- It remains a fortnightly program and the first fortnight commences 28 September 2020.

- Employers must re-test their eligibility for the program.

- The decline in turnover thresholds of 15% (registered charities), 30% or 50% (depending on aggregated turnover) are still in place.

- The testing period for the fortnights commencing 28th September is the September 2020 quarter actual turnover, comparing to the September 2019 actual turnover. Default testing information will be BAS lodgements.

- Employers will need to re-test eligibility again for fortnights commencing 4 January, using the actual December 2020 quarter turnover.

- The program will come to an end of 28 March 2021.

- Alternative tests will be available, but right now have not been detailed.

- There are now two payment tiers in place, depending on whether or not the employees in question worked an average of 20 hours per week in either February or June 2020. These are:

- 28 September to 3 January:

- $1,200 per fortnight if average hours exceed 20 per week, or

- $750 per fortnight if average hours were less than 20 per week

- 4 January to 28 March:

- $1,000 per fortnight if average hours exceed 20 per week, or

- $650 per fortnight if average hours were less than 20 per week