Comparing JobKeeper and JobKeeper 2.0

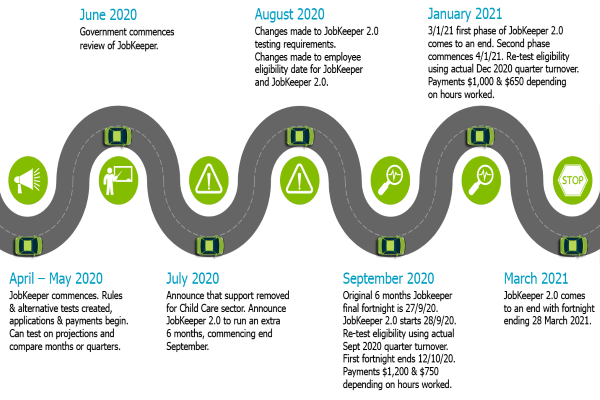

On Monday 15 September the Government released the 8th amendment to the JobKeeper rules, which in this case was the formalisation of what has been called JobKeeper 2.0. There has recently been some confusion of the overlap between JobKeeper and JobKeeper 2.0, which we clarified here and in the image below.

The new rules are largely consistent with what has been announced already and there are still some further details to be provided by the ATO around alternative tests. Here we will compare the current and new JobKeeper programs and highlight some known details of new aspects of the program.

Here is a summary of the key features of JobKeeper and JobKeeper 2.0, followed by further details on the newest concepts.

| Same | Different |

|---|---|

| Business eligibility criteria, so it is still not open to businesses that don’t meet the original March 2020 requirements. Reimbursement is still in arrears and requires the minimum payments are made to employees each fortnight. | Two tiered payment rate based on hours worked by employees/business participants. |

| Employee eligibility criteria, including the recent changes to eligibility date from 1 March to 1 July. | Rate of payment is now dependent on whether employee/business participant hours worked exceed 80 in certain test periods. |

| Decline in turnover thresholds remain at 15%, 30% or 50% depending on your organisation. Turnover is either actual or projected, based on projected GST turnover. | The test is now based on actual turnover and the ‘current GST turnover’ concept, not projected turnover. It is expected that for September and December 2020 this will align with BAS lodgements. There is no option to test months, only quarters. |

| The program runs for 6 months (with original JobKeeper ending 27 September). | Employers need to test their eligibility against decline in turnover to qualify for the period 28 September to 3 January and/or 4 January to 28 March. |

| Alternative tests are available where the prior corresponding period is not an appropriate basis for comparison. | The alternative tests for 2.0 are not yet released, but will require an alternative test period of a quarter. There will also be alternative tests in relation to the 80 hours worked thresholds. |

| Notification requirements to both employees and the ATO. | The ATO only needs to be notified of enrolment in the program for new entrants. ATO requires notification of which rate the employees and business participants are on. Employees need to be notified of whether they are on the higher or lower rate. |

| A person can only claim from one employer at a time and casual staff with a permanent position elsewhere cannot receive JobKeeper support. | |

| The integrity rules to ensure that employers do not inappropriately access JobKeeper and that anyone who receives it that shouldn’t is liable to repay it in the future. | |

| Record keeping requirements, stating records must be kept for 5 years. |

Payment Rate

The two tiered payment rates for the JobKeeper 2.0 extended periods are as follows:

- 28 September to 3 January:

- $1,200 per fortnight if on the higher rate, or

- $750 per fortnight if on the lower rate.

- 4 January to 28 March:

- $1,000 per fortnight if on the higher rate, or

- $650 per fortnight if on the lower rate.

Higher And Lower Rates And Hours Worked

The higher and lower rates depends on each eligible employee’s total working hours in the applicable ‘reference period’. If the hours worked exceeded 80 in the reference period, then the employee receives the higher rate, otherwise they are on the lower rate. Hours worked includes paid work, paid leave and paid public holidays.

For eligible employees, the reference period is either:

- The 28 day period ending at the most recent pay cycle for the employee that ended before 1 March 2020; or

- The 28 day period ending at the most recent pay cycle for the employee that ended before 1 July 2020.

If an employee was eligible for both periods, then the employer needs to nominate the period that results in the higher payment rate. If the employer’s pay cycle is greater than 28 days (monthly pay), then it needs to be prorated for the test.

The reference period for an eligible business participant or religious practitioner is the month of February 2020. A business participant must be in a position to reasonably demonstrate that they were actively engaged in the business for the required 80 hours during February 2020. This could include working on business development and planning and regulatory compliance.

Employers and business participants/religious practitioners both do not have to and cannot re-test hours for the higher and lower rates if they are eligible for the second extended period of 4 January to 28 March. The reference periods are currently locked in February and June (unless an alternative test is applicable).

Treasury examples of testing hours

Fortnightly pay cycles

Using the 28 day period ending at the end of the most recent pay cycle before 1 March 2020 – the relevant pay cycle fortnights are from 1 February 2020 until 14 February 2020; and 15 February 2020 until 28 February 2020. During this 4 week period, Emma worked 15 hours in week 1, 22 hours in week 2, 18 hours in week 3 and in week 4 she did not work and took 15 hours of annual leave. Emma’s hours of work and paid leave in this reference period total 70 hours.

Using the 28 day period ending at the end of the most recent pay cycle before 1 July 2020 – the relevant pay cycle fortnights are from 23 May 2020 until 5 June 2020; and 6 June 2020 until 19 June 2020. During this 4 week period, Emma worked 15 hours in week 1, 20 hours in week 2, 10 hours in week 3, and 10 hours in week 4. Emma’s hours for work in this reference period total 55 hours.

Under the two reference periods, the business qualifies for JobKeeper payments in respect of Emma based on the most beneficial reference period.

Monthly pay cycles

Using 28 day period ending at the end of the most recent pay cycle before 1 March 2020 – the relevant pay cycle is from 16 January 2020 until 15 February 2020 (31 days). During this period, Antonio worked for 85 hours and took 80 hours of combined annual and long service leave. For the purposes of the JobKeeper payment, Antonio’s hours of work (pro-rated) for this reference period is just over 149 hours, worked out as follows: 28/31 x (80 + 85) hours = approx. 149 hours.

Using the 28 day period ending at the end of the most recent pay cycle before 1 July 2020 – the relevant pay cycle is from 16 May 2020 until 15 June 2020 (31 days). During this period, due to the impacts of COVID‑19, Antonio only worked for 85 hours. For the purposes of the JobKeeper payment, Antonio’s hours of work (pro-rated) for this reference periods is 76.8 hours, worked out as follows: 28/31 x 85 hours.

The business qualifies for JobKeeper payments in respect of Antonio based on the most beneficial reference period, which is the 28 day period at the end of the most recent pay cycle before 1 March 2020. Under the hours worked for this reference period, Antonio meets the required 80 hour threshold for the higher rate of JobKeeper payments.

Alternative Tests And Further Guidance

The Commissioner of Taxation retains the authority to issue alternative tests for certain aspects of JobKeeper. At the time of writing, we are still awaiting details on alternative tests for:

- Decline in turnover for when the previous comparison period is not an appropriate basis to test against. Alternative tests already exist for JobKeeper, but will need updating for JobKeeper 2.0

- Hours worked. The Explanatory Memorandum has highlighted 4 scenarios where an alternative test is expected to apply:

- Less than 80 hours worked in the reference period, but that wasn’t typical of the employees usual work patterns

- Unpaid leave was taken during the reference period (including maternity leave and workers compensation related leave)

- An employee commenced during the reference period and didn’t work the full 28 days

- The employee was not employed in the reference period, but is eligible under the change of business rules

Key Actions Required Prior To 12 October

The end of the first fortnight of JobKeeper 2.0 is 12 October 2020. Although it is likely there will be some extension of time to sort out administrative issues, businesses will need to have completed the following in relation to JobKeeper 2.0 by 12 October:

- Re-test eligibility comparing the September 2020 quarter actual GST turnover against September 2019 (or alternative period if applicable).

- Notify the ATO if a new entrant into the program.

- Test the hours of all eligible employees to work out who gets the higher or lower rate, including considering alternative tests for hours worked.

- Notify the ATO of which employees are on the higher and lower rate.

- Notify the employees whether they on the higher or lower rate.

- Ensure that the minimum fortnightly wage has been paid to relevant employees.

Please contact your Accru Melbourne representative on (03) 9835 8200 if you have any queries about the points above or to find out more about JobKeeper.